Bayfront Infrastructure Capital

Bayfront Infrastructure Capital (“BIC”) was established in connection with the creation of an Infrastructure Take-Out Facility (“TOF”) that was designed and structured by Clifford Capital to mobilise institutional capital for infrastructure debt in Asia-Pacific and the Middle East. This was achieved by a simultaneous issuance of securitisation notes and acquisition of loan assets from five contributing banks, thus facilitating the transfer of exposure in long-term project and infrastructure loans from banks to institutional investors.

The BIC transaction offers investors exposure to a pre-assembled portfolio of marquee project and infrastructure loans to borrowers in Asia-Pacific and the Middle East, through the first ever infrastructure project finance securitisation in Asia.

The Rated Notes issued by BIC were fully redeemed on 31 August 2022 (following the expiry of the Non-Call Period on 11 July 2022), as a result of Clifford Capital (as Subordinated Noteholder and Collateral Manager) exercising its early redemption option on the Rated Notes.

Investor Relations

Offering Document

Moody’s Rating Reports

Redemption Notice

Payment Date and Investor Reports

Issuance

Four classes of Notes

The Class A Notes, Class B Notes and Class C Notes are rated by Moody’s and listed on the Singapore Exchange. The Subordinated Notes are solely held by Clifford Capital as Sponsor and Manager of the transaction.

| Class | Amount Issued (US$ million) |

Amount Outstanding2 (US$ million) |

Issue Ratings (Moody’s) |

Spread4 | Legal Maturity Date | |

|---|---|---|---|---|---|---|

| Original | Current3 | |||||

| A | 320.6 | - | Aaa (sf) | Aaa (sf) | 145 bps | 11-Jan-2038 |

| B | 72.6 | - | Aa3 (sf) | Aa1 (sf) | 195 bps | 11-Jan-2038 |

| C | 19.0 | - | Baa3 (sf) | A2 (sf) | 315 bps | 11-Jan-2038 |

| Subordinated1 | 45.8 | 0 | Not rated | Not rated | N.A. | 11-Jan-2038 |

1 Retained and not offered

2 The remaining principal amounts on the Class A, B and C Notes were fully redeemed on 31 August 2022

3 Last rating of the Notes prior to their full early redemption on 31 August 2022

4 Spread is applied over 6 months LIBOR

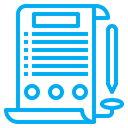

Key Transaction Parties

Clifford Capital is the Sponsor and Manager for the TOF.

As Sponsor, Clifford Capital was responsible for:

- sourcing of the Portfolio from the Contributing Banks and executing loan transfers, including initial screening, credit analysis, due diligence and documentation;

- liaising with credit rating agencies to obtain credit assessments on the portfolio assets and credit ratings for the Class A, B and C notes (“Rated Notes”); and

- leading the structuring and execution of the transaction, including resourcing arrangements, investor marketing and distribution, together with the Joint Lead Managers.

As Manager, Clifford Capital is providing certain investment management, administrative and advisory functions for Bayfront Infrastructure Capital which includes:

- managing and monitoring the performance of the portfolio assets;

- maintaining credit assessments on the portfolio assets and credit ratings of the Rated Notes;

- handling any replenishment and disposition of the assets (if required);

- handling all voting requirements, consents, amendments, modifications, waivers or any other notices for the portfolio assets;

- providing information available to the Transaction Administrator and ensuring that the Transaction Administrator operates the Priority of Payments and reporting requirements in a timely and accurate manner;

- providing management services including periodic investor reporting, treasury, compliance and budgeting requirements (in conjunction with the Transaction Administrator); and

- acting as primary interface with investors, banks, borrowers, multilateral financial institutions, export credit agencies and other stakeholders, including investor relations.

Deutsche Bank AG, Singapore Branch is the Transaction Administrator for the facility, performing portfolio administration and reporting services. DB International Trust (Singapore) Limited is acting as Trustee, DBS Bank Ltd as the Account Bank and TMF Singapore H Pte. Ltd. as the Corporate Service Provider.

There are five Contributing Banks who along with Clifford Capital transferred their project and infrastructure loan assets to Bayfront Infrastructure Capital.

Transaction Features and Highlights

- 37 Asia Pacific and Middle East Project & Infrastructure Loans

- 16 countries of project and 8 sub-sectors

- Alignment of interests with Clifford Capital acting as the sponsor, manager and sole investor in first-loss tranche

- Deep portfolio management expertise

- Well-seasoned and performing loans

- Over 30% of portfolio benefits from credit enhancement provided by export credit agencies and multilateral financial institutions

- Offtake agreements with reputable and creditworthy counterparties

- Natural FX and interest rate hedge – US$-denominated and floating rate

- Multiple review and credit approval processes by originating banks, multilateral institutions providing credit enhancements, as well as Clifford Capital

- Detailed analysis undertaken by credit rating agencies for each underlying loan

Overview of the Portfolio

The Portfolio is diversified across 37 project finance and infrastructure loans, spread among 8 industry sub-sectors, and located in 16 countries across the rapidly-growing Asia-Pacific and Middle East regions. The Portfolio is backed by 30 projects with stable and predictable long-term cash flows, including through offtake agreements entered with reputable and creditworthy counterparties including major global corporates, state-owned enterprises and government or government-linked sponsors.

Clifford Capital believes that this Portfolio is broadly representative of the recent geographical and sectoral activity in the infrastructure and project finance industry across Asia-Pacific and the Middle East. The underlying loan portfolio sector exposure has also been designed to mirror Clifford Capital’s areas of experience and domain expertise.

By Country of Project

Based on geographical project location

By Country of Risk

Based on ultimate source of payment risk

By Sector

Based on indicative sector categorisation

By Credit Enhancement

By Ratings Distribution1

Based on Moody’s credit estimate

1 By Moody’s Rating Factor. Note: majority of 1766 – 2220 (Ba3 – B1) loans consists of loans with credit estimates of 1766 (Ba3).

By “Deep” Emerging Markets Exposure2

36% of the portfolio is exposed to deep EM exposure (within this, 27% receive credit enhancement support)

2 Defined as countries rated Ba3 and below by Moody’s. Includes Bangladesh, Jordan, Mongolia, Papua New Guinea, Sri Lanka and

Vietnam.

ECA = Export Credit Agency; IFC = International Finance Corporation (member of the World Bank Group); NHSFO =

Non-Honouring of Sovereign Financial Obligation guarantee, provided by the Multilateral Investment Guarantee Agency (MIGA, member of the

World Bank Group); PRI = Political Risk Insurance provided by MIGA

By Commodity Price Exposure3

34% of the portfolio is exposed to commodity price risk, while remaining 66% are underpinned by robust availability-based or fixed price offtake or charter contracts

3 Within the unwrapped exposure category, 6% points comprise loans with a sponsor guarantee

By Construction Risk

24% of the portfolio is nearing completion, but this entire portion is supported by explicit and irrevocable sovereign or sponsor guarantees

Portfolio Selection Principles

The following are the key selection principles that Clifford Capital has applied in selecting and constituting the Portfolio:

Structure and Sourcing

- Sourced from leading international and regional banks and Clifford Capital

- Focused on projects in Asia-Pacific and the Middle East that are operational or in advanced stages of construction, but which benefit from appropriate credit mitigants, such as sovereign or completion guarantees

- Material portion supported by export credit agencies, multilateral financial institutions and project sponsors through various forms of credit enhancement (e.g. guarantees and insurance)

- Focused on availability-based infrastructure assets

- Oil and gas, metals and mining and energy shipping sub-sectors subject to concentration limits

Cashflows

- US$-denominated floating rate loans, reflecting the US$ payment profile for interest and principal on the Notes issued

- Fixed loan repayment schedules providing certainty on cash flows

Investor Profiles

By Investor Type

By Geography

“Notes issued by Bayfront Infrastructure Capital Pte. Ltd. (“BIC Notes”) may not be offered or sold within the United States.

(a) The Information Memorandum relating to the BIC Notes, and (b) general information (collectively, the “Information”) contained herein is for information purposes only. It neither constitutes an offer nor an invitation nor a recommendation to subscribe for or to purchase, to hold or sell notes, nor is the Information contained herein meant to be complete or to serve as a basis for any kind of obligation, contractual or otherwise. The Information posted on this page is being provided as a historical, reference source only and is not being used, and no one is authorized to use, disseminate or distribute it, in connection with any offer, invitation or recommendation to sell or issue, or any solicitation of any offer to purchase or subscribe for, notes. The Information is current only as at its date and such availability of the Information on this website shall not create any implication that there has been no change in Bayfront Infrastructure Capital Pte. Ltd.’s affairs since the date of the Information or that the information, statements or opinions contained therein are current as at any time subsequent to such date. Bayfront Infrastructure Capital Pte. Ltd. is under no obligation to update the information on this page. The Information may contain forward-looking statements, estimates and projections. Such statements, estimates and projections are not guarantees of future performance and undue reliance should not be placed on them.”