Bayfront Infrastructure Capital III

Bayfront Infrastructure Capital III Pte. Ltd. (“BIC III”) is Bayfront’s third offering of Infrastructure Asset-Backed Securities (“IABS”) that was priced in September 2022. BIC III issued 4 classes of rated Notes that are listed on the Singapore Exchange and an unrated equity tranche that is fully retained by Bayfront, offering investors exposure to a pre-assembled portfolio of marquee project and infrastructure loans to borrowers in Asia-Pacific, the Middle East and the Americas.

Just like its predecessor BIC II, the BIC III transaction also featured a dedicated sustainability tranche, in the form of the Class A1-SU Notes, backed by eligible green and social assets as defined in Bayfront’s Sustainable Finance Framework. The Class A1-SU Notes are considered as Secured Sustainability Standard Bonds under the June 2022 edition of the ICMA Green Bond Principles, Social Bond Principles and Sustainability Bond Guidelines. The Class A1-SU Notes have also been recognised by the Singapore Exchange for meeting recognised standards for green, social or sustainability fixed income securities.

Investor Relations

Offering Document

Moody’s Rating Reports

Payment Date and Investor Reports

Audited Financial Statements

Issuance

Four classes of Notes

The Class A1 Notes, Class A1-SU Notes, Class B Notes and Class C Notes are rated by Moody’s and listed on the Singapore Exchange. The Preference Shares are solely held by Bayfront as Sponsor of the transaction.

| Class | Amount Issued (US$ million) |

Amount Outstanding3 (US$ million) |

Issue Ratings (Moody’s) |

Spread4 | Legal Maturity Date | |

|---|---|---|---|---|---|---|

| Original | Current | |||||

| A1 | 187.9 | 130.7 | Aaa (sf) | Aaa (sf) | 155 bps | 11-Apr-2044 |

| A1-SU | 110.0 | 76.5 | Aaa (sf) | Aaa (sf) | 150 bps | 11-Apr-2044 |

| B | 33.4 | 33.4 | Aa1 (sf) | Aaa (sf) | 230 bps | 11-Apr-2044 |

| C1 | 43.0 | 43.0 | Baa3 (sf) | Baa1(sf) | 460 bps | 11-Apr-2044 |

| Pref Shares2 | 30.2 | 30.2 | Not rated | Not rated | N.A. | - |

1 The Class C Notes were issued at an Original Issue Discount of 4.2% for issuance proceeds of US$41.2 million, with an incremental US$1.8 million of Preference Shares being issued to cover the cost of this discount

2 Retained and not offered

3 As of 11 April 2024

4 Spread is applied over 6-month Term SOFR

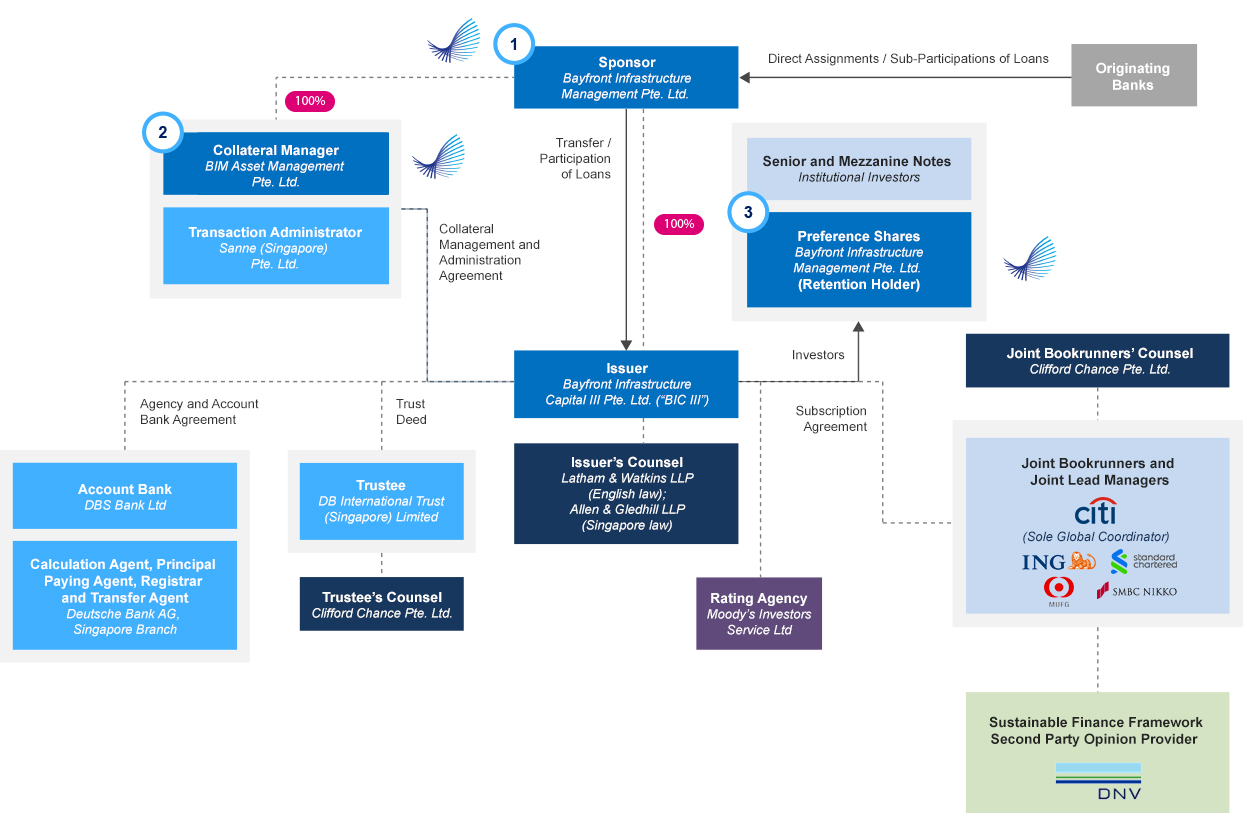

Key Transaction Parties

Bayfront is the Sponsor for BIC III.

As Sponsor, Bayfront was responsible for:

- sourcing of the Portfolio from the Originating Banks and executing loan transfers, including initial screening, credit analysis, due diligence and documentation;

- liaising with credit rating agencies to obtain credit assessments on the portfolio assets and credit ratings for the Class A1, A1-SU, B and C notes (“Rated Notes”); and

- leading the structuring and execution of the transaction, including resourcing arrangements, investor marketing and distribution, together with the Sole Global Coordinator and Joint Bookrunners.

BIM Asset Management Pte. Ltd. (“BIMAM”) is the Collateral Manager for BIC III.

As Manager, BIMAM is providing certain investment management, administrative and advisory functions for BIC III which includes:

- managing and monitoring the performance of the portfolio assets;

- maintaining credit assessments on the portfolio assets and credit ratings of the Rated Notes;

- handling any replenishment and disposition of the assets (if required);

- handling all voting requirements, consents, amendments, modifications, waivers or any other notices for the portfolio assets;

- providing information available to the Transaction Administrator and ensuring that the Transaction Administrator operates the Priority of Payments and reporting requirements in a timely and accurate manner;

- providing management services including periodic investor reporting, treasury, compliance and budgeting requirements (in conjunction with the Transaction Administrator); and

- acting as primary interface with investors, banks, borrowers, multilateral financial institutions, export credit agencies and other stakeholders, including investor relations.

Apex Fund and Corporate Services Singapore 1 Pte. Limited is the Transaction Administrator for BIC III, performing portfolio administration and reporting services. DB International Trust (Singapore) Limited is acting as Trustee and DBS Bank Ltd. as the Account Bank.

The Issuer (BIC III) is a wholly owned subsidiary of the Sponsor (Bayfront). Bayfront holds all of the ordinary shares and preference shares in BIC III.

Transaction Features and Highlights

- 28 project and infrastructure loans across 26 projects in Asia Pacific, the Middle East and the Americas

- 13 countries of project and 8 industry sub-sectors

- 84% of the portfolio at inception relates to operational projects, while the remaining 16% relates to projects in advanced stages of construction and which benefit from appropriate credit mitigants, such as sponsor completion guarantees or sponsor support

- 50% of the portfolio at inception are investment-grade assets, with a Moody’s Rating Factor of 610 (Baa3) or lower (based on Moody’s existing credit estimate disclosure policy introduced in March 2022, which no longer incorporates the benefit of external credit support for loans covered by export credit agencies or multilateral financial institutions)

- Stringent review and credit approval processes – firstly by the originating banks, an any export credit agencies and multilateral financial institutions providing credit support, and secondly by Bayfront as part of its due diligence process when acquiring the loans as sponsor

- Detailed analysis undertaken by credit rating agencies to assign credit estimates for each underlying loan

- Alignment of interests with Bayfront acting as the sponsor and sole investor in first-loss tranche

- Deep portfolio management expertise, with BIMAM acting as the collateral manager for BIC III, and also acting as the collateral manager for BIC II transaction (issued in 2021) and as sub-manager on the BIC transaction (issued in 2018)

- Static pool with limited replenishment rights within a 3-year replenishment and 3-year non-call period

- Offtake agreements with reputable and creditworthy counterparties

- 74% of the portfolio involves project borrowers that need to maintain minimum debt service coverage ratios as one of their financial covenants

- Natural FX and interest rate hedge – US$-denominated and floating rate assets and liabilities

- 29% of the Notes issued are to be fully allocated to a portfolio of eligible green and social assets that meet the eligibility criteria stated in Bayfront’s Sustainable Finance Framework

- 30% of the portfolio at inception relates to eligible green assets (renewable energy projects and energy efficient data centres), enhancing BIC III’s green footprint from the previous BIC II transaction that was issued in June 2021

Overview of the Portfolio

The Portfolio is diversified across 28 project finance and infrastructure loans, spread among 8 industry sub-sectors, and located in 13 countries across Asia Pacific, the Middle East and the Americas. The Portfolio is backed by 26 projects with stable and predictable long-term cash flows, including through offtake agreements entered with reputable and creditworthy counterparties including major global corporates, state-owned enterprises and government or government-linked sponsors.

The Portfolio has been assembled with a focus on availability-based infrastructure assets in the conventional power and water and renewable energy subsectors, while also including assets from other sub-sectors, subject to strong credit metrics and pre-set concentration limits put in place by Bayfront. Accordingly, Bayfront believes that the diversification within the Portfolio is a significant mitigant to geographical, industry or corporate and consumer business-cycle risks.

By Country of Project

Based on geographical project location

By Country of Risk

Based on ultimate source of payment risk

By Sector

By Credit Enhancement

By Ratings Distribution1

1 As calculated by Bayfront using Moody’s Rating Factors based on Moody’s previous credit estimate disclosure policy that incorporates the benefit of external credit support for loans covered by export credit agencies and multilateral financial institutions.

By “Deep” Emerging Markets Exposure2

2 Defined as countries rated Ba3 and below by Moody’s. Includes Bangladesh, Cambodia and Papua New Guinea.

ECA = Export Credit Agency; NHSFO = Non-Honouring of Sovereign Financial Obligation guarantee, provided by the Multilateral Investment Guarantee Agency (MIGA, member of the World Bank Group); PRI = Political Risk Insurance provided by MIGA

By Commodity Price Exposure

Based on ultimate source of payment risk

By Construction Risk

Based on ultimate source of payment risk

Portfolio Selection Principles

The following are the key selection principles that Bayfront has applied in selecting and constituting the Portfolio:

Structure and Sourcing

- Sourced from 13 leading international and regional commercial banks and from Bayfront Infrastructure Capital (BIC)

- Focused on projects in Asia-Pacific, the Middle East and the Americas that are operational or in advanced stages of construction, but which benefit from appropriate credit mitigants, such as completion guarantees

- Material portion supported by export credit agencies, multilateral financial institutions and project sponsors through various forms of credit enhancement (e.g. guarantees and insurance)

- Focused on availability-based infrastructure assets

- LNG and gas, Floating production, storage and regasification, Other oil and gas, Metals and mining sub-sectors subject to concentration limits

Cashflows

- US$-denominated floating rate loans, reflecting the US$ payment profile for interest and principal on the Notes issued

- Fixed loan repayment schedules providing certainty on cash flows

Sustainability Tranche

Just like its predecessor BIC II, the BIC III transaction has also featured a dedicated sustainability tranche, in the form of the Class A1-SU Notes, The Class A1-SU Notes are considered as Secured Sustainability Standard Bonds under the June 2022 edition of the ICMA Green Bond Principles, Social Bond principles and Sustainability Bond Guidelines.

- 29% of the Notes issued are to be fully allocated to a portfolio of eligible green and social assets that meet the eligibility criteria stated in Bayfront’s Sustainable Finance Framework

- 30% of the portfolio at inception relates to eligible green assets (renewable energy projects and energy efficient data centres), enhancing BIC III’s green footprint from the previous BIC II transaction that was issued in June 2021

DNV Business Assurance Singapore Pte. Ltd. has provided a sustainability bond pre-issuance eligibility assessment on the Class A1-SU Notes.

The Class A1-SU Notes have also been recognised by the Singapore Exchange for meeting recognised standards for green, social or sustainability fixed income securities.

Asset Pool by Original Loan Commitments

| Green Use of Proceeds | Asset Category | USD (mln) |

|---|---|---|

| Solar Energy Projects | Renewable Energy | 49.890 |

| Wind Energy Projects | Renewable Energy | 24.432 |

| Run-of-River Hydro Projects | Renewable Energy | 20.687 |

| Data Centre Projects | Energy Efficiency | 25.000 |

| Social Use of Proceeds | Asset Category | Social Benefit | Target Population | USD (mln) |

|---|---|---|---|---|

| Desalination Investments | Affordable Basic Infrastructure | Climate resilient drinking water supply | Residents in Qatar, Kuwait and Saudi Arabia | 31.454 |

| Transmission and Distribution Investments | Affordable Basic Infrastructure | Access to electricity | Residents in villages from North Phnom Penh to Kampong Chan, Cambodia | 12.300 |

| Total | 163.763 |

Investor Profiles

By Investor Type

By Geography

Notes issued by Bayfront Infrastructure Capital III Pte. Ltd. (“BIC III Notes”) may not be offered or sold within the United States.

(a) The Information Memorandum relating to the BIC III Notes, and (b) general information (collectively, the “Information”) contained herein is for information purposes only. It neither constitutes an offer nor an invitation nor a recommendation to subscribe for or to purchase, to hold or sell notes, nor is the Information contained herein meant to be complete or to serve as a basis for any kind of obligation, contractual or otherwise. The Information posted on this page is being provided as a historical, reference source only and is not being used, and no one is authorized to use, disseminate or distribute it, in connection with any offer, invitation or recommendation to sell or issue, or any solicitation of any offer to purchase or subscribe for, notes. The Information is current only as at its date and such availability of the Information on this website shall not create any implication that there has been no change in Bayfront Infrastructure Capital III Pte. Ltd.’s affairs since the date of the Information or that the information, statements or opinions contained therein are current as at any time subsequent to such date. Bayfront Infrastructure Capital III Pte. Ltd. is under no obligation to update the information on this page. The Information may contain forward-looking statements, estimates and projections. Such statements, estimates and projections are not guarantees of future performance and undue reliance should not be placed on them.