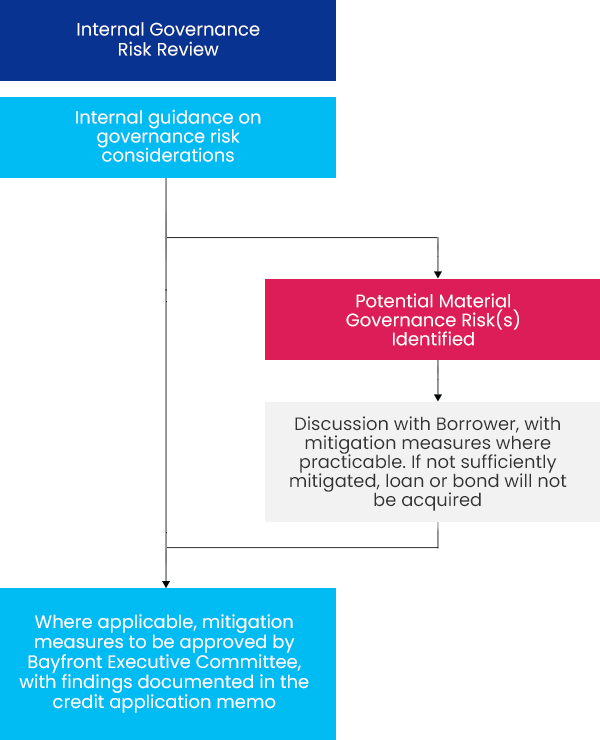

Governance Risk Assessment

Bayfront adheres to the following internal governance risk review process for assessing and evaluating governance related risks of its investments.

Phase 1: Screening

- During the pre-screen stage, an early red flags screening for adverse governance-related issues will be conducted.

- In the event of material red flags, to escalate to Bayfront CEO who can opt to discuss the matter with the Bayfront Executive Committee (ExCo) if deemed necessary, prior to pre-screening.

Phase 2: Due Diligence

- During the due diligence stage, internal governance risk should be assessed and evaluated on a “best efforts” basis based on available information.

- In the case that material corporate governance risks were identified during the due diligence phase, these will be discussed with the borrower with mitigation measures, where practicable.

- Given the nature of Bayfront’s business where most of its loans are acquired on a secondary basis, such direct discussions with the Borrower may not be possible. If Bayfront considers that material corporate governance risks are not sufficiently mitigated, the asset will not be acquired.

Phase 3: Credit Approval

- Any proposed mitigation measures shall be approved by the Bayfront ExCo and documented in the credit application accordingly. Overall governance findings shall also be summarised and documented in the credit application memo.